An expense report example is an informational report which provides all necessary information regarding expenses conducted during a specific period or months. This report is very helpful in providing information like; what are total expenses in a month and how many expenses are made during a specific month or week. If a company wishes to hire new employees, this report can highlight expenses which were incurred in completing the hiring process. An expense report is also necessary because it actually sets a balance record of expenses according to the budget planned by an organization in a specific time. If a business spends more on petty expenses than they estimate, this report can be used to highlight that increasing percentage. Expense reports are inevitable for better managerial controls as they not only responsible for keeping petty cash expenses at desired level, but also part of financial reports. It provides actual figures which are further used in the preparation of crucial financial reports.

Importance of Expense Report

Business expansion and development is one of the toughest times for a business. During that period, a business incurs more expenses than they have planned to expense. For instance; hiring of new staff, installation of new plants and machinery; launching of new products, and opening of new offices or showrooms. Hiring of new staff is a mandatory part of business expansion as they are necessary to run a business. However, the hiring process embeds higher expenses, which a business will need to incur. So, in this scenario, preparing an expense report can be a means in which management can add details about how many employees are actually needed, at what managerial levels, an organization is required; for example, a manager, a waiter, a staff, or a security guard. It is an expense report which can give an idea about how much expenses a business has incurred in past and how much they have incurred for current hiring. An expense report can also be an alarming report, especially when a business is observing higher rates of daily or weekly expenses. As the petty cash log reports higher percentage of expenses, a management can revise their monthly budget accordingly. Similarly, if a business wants to start something new or if they decide to launch a new project, everything will happen exactly the same way as described above.

Advantages of Expense Report

An expense report has many advantages as firstly, it gives exact idea about expenses. By regularly monitoring this report, a company can understand where they need to expense more and where there is no need to expense more. With the guidance of this report, an organization finds it easy to launch new projects or products as they get an estimated idea about their expense even before they start it. As far as future planning is concerned, an expense report comes in handy to organize all arrangements well in advance. Without this report, it will be very difficult for anyone to make their next budget. Secondly, they will have no idea how much amount they are spending on account of petty cash expenses. An expense report, if not prepared, can cause of wastage of resources, as management would not be in a position to learn how much they have spent already and how much more is necessary to spend. Similarly, they cannot make sure to expense exactly as they are allocated for each expense. For better control, it is highly crucial to learn where a business has spent more money and where they didn’t spend. That is the reason, an expense report can save us from many big mistakes and wrong payments.

Examples for Expense Report

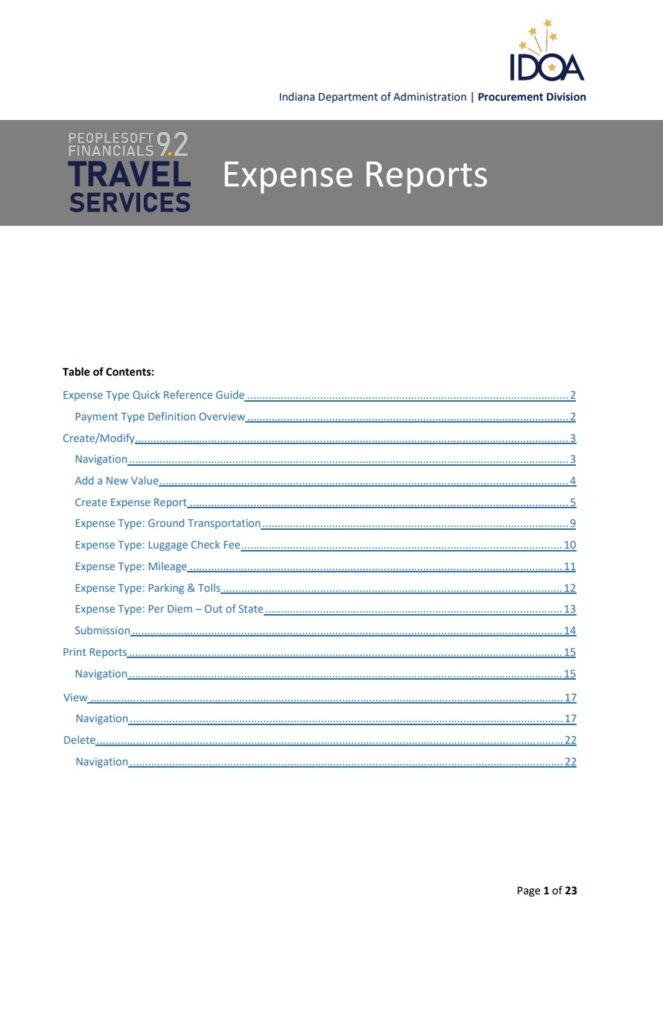

Source:www.in.gov

Source:www.in.gov

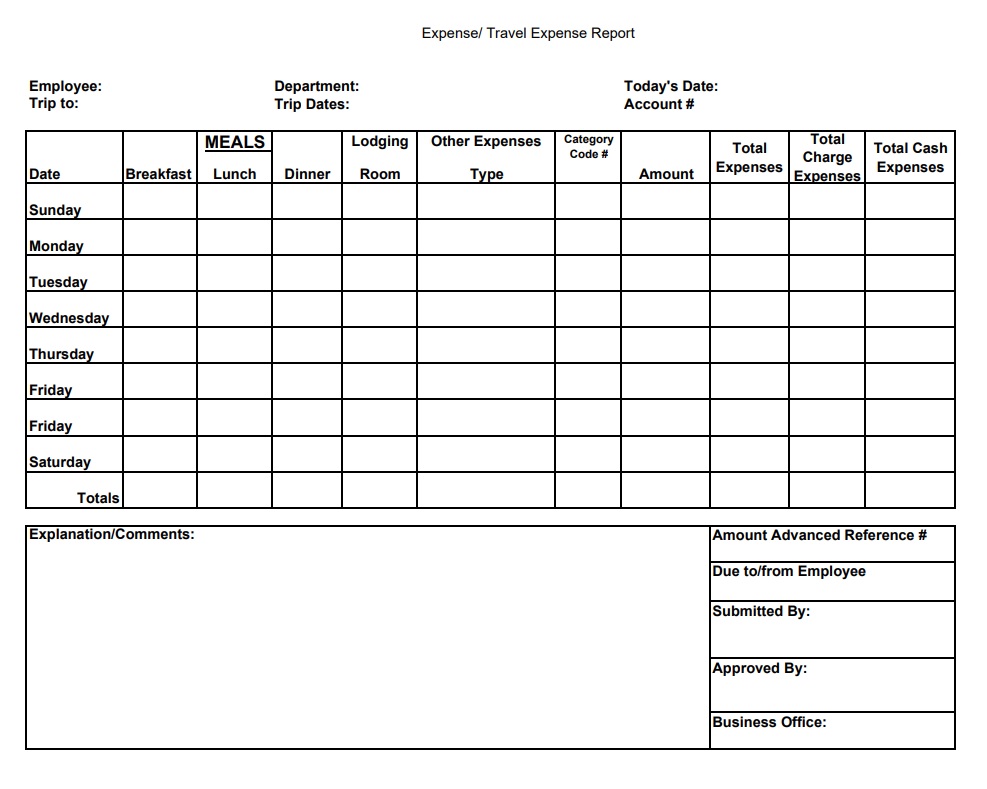

Source:hr.mcm.edu

Source:hr.mcm.edu

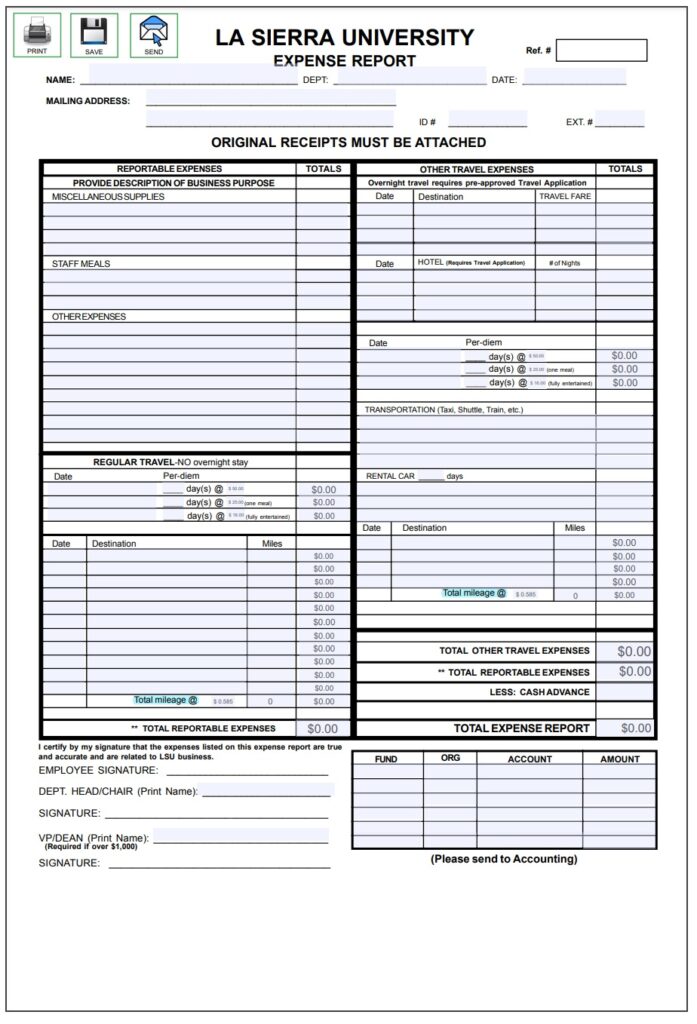

Source:lasierra.edu

Source:lasierra.edu

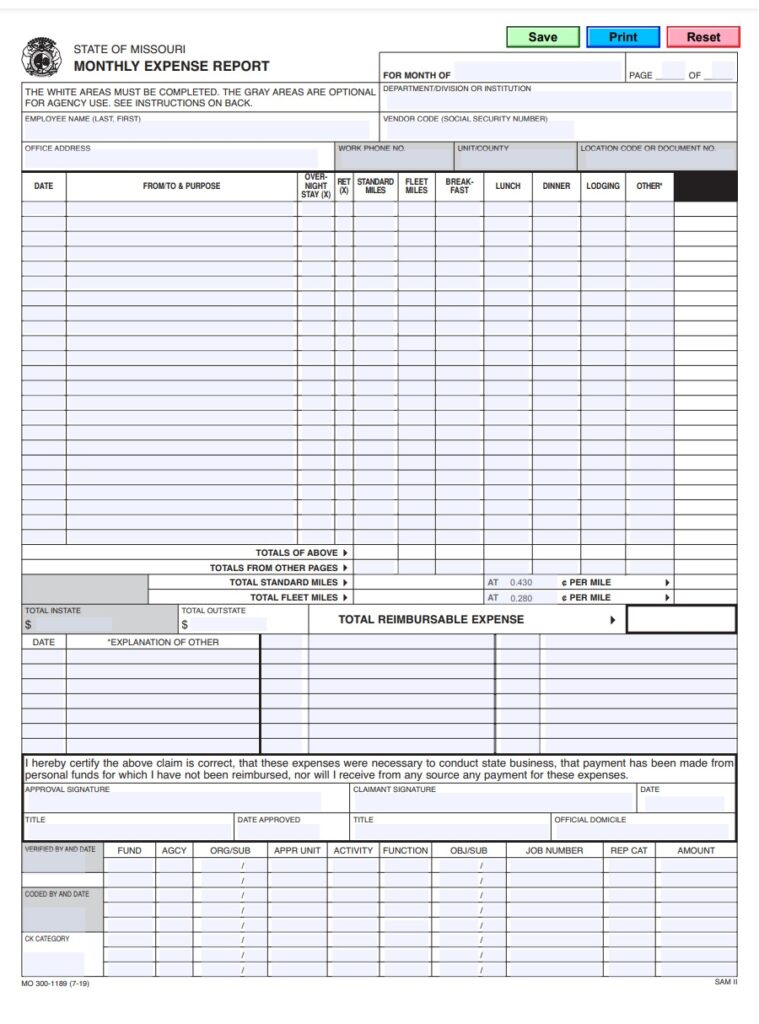

Source:oa.mo.gov

Source:oa.mo.gov

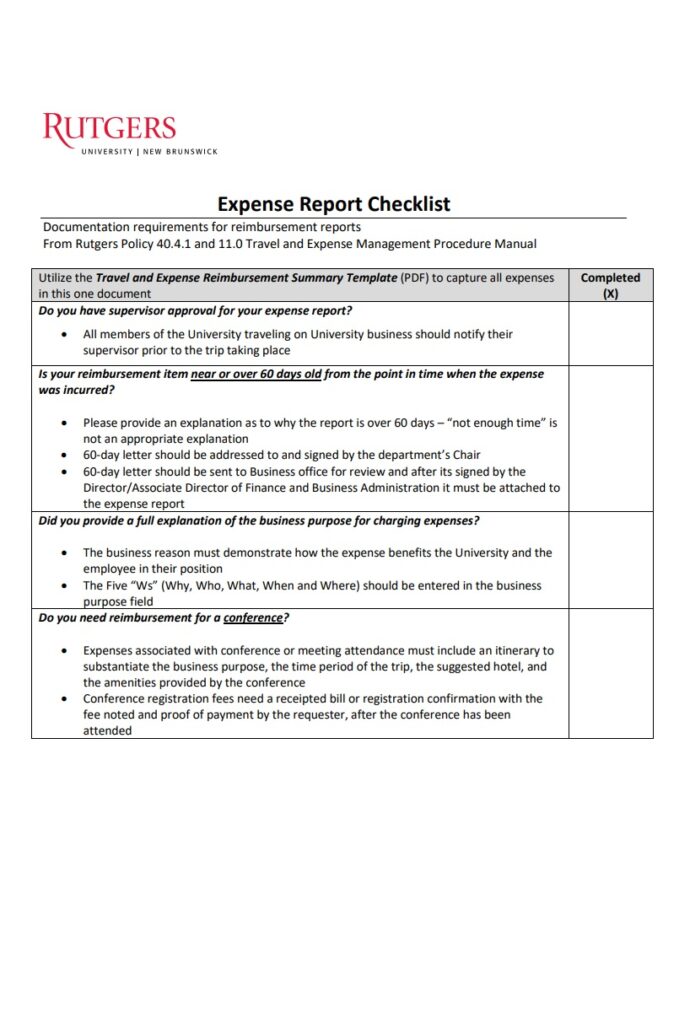

Source:ofba.rutgers.edu

Source:ofba.rutgers.edu

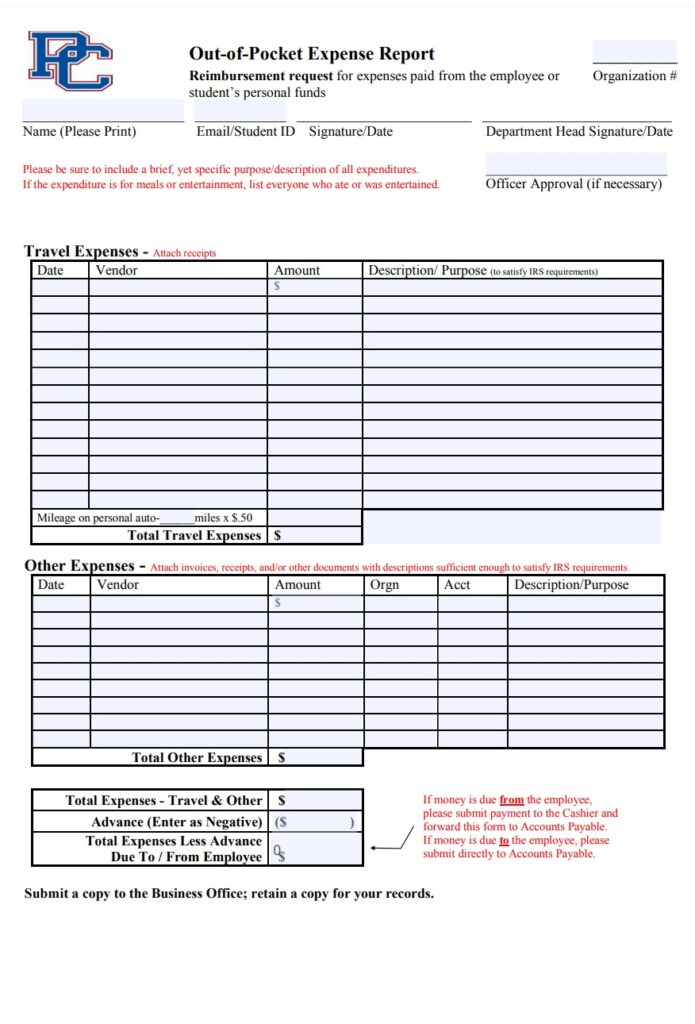

Source:www.presby.edu

Source:www.presby.edu

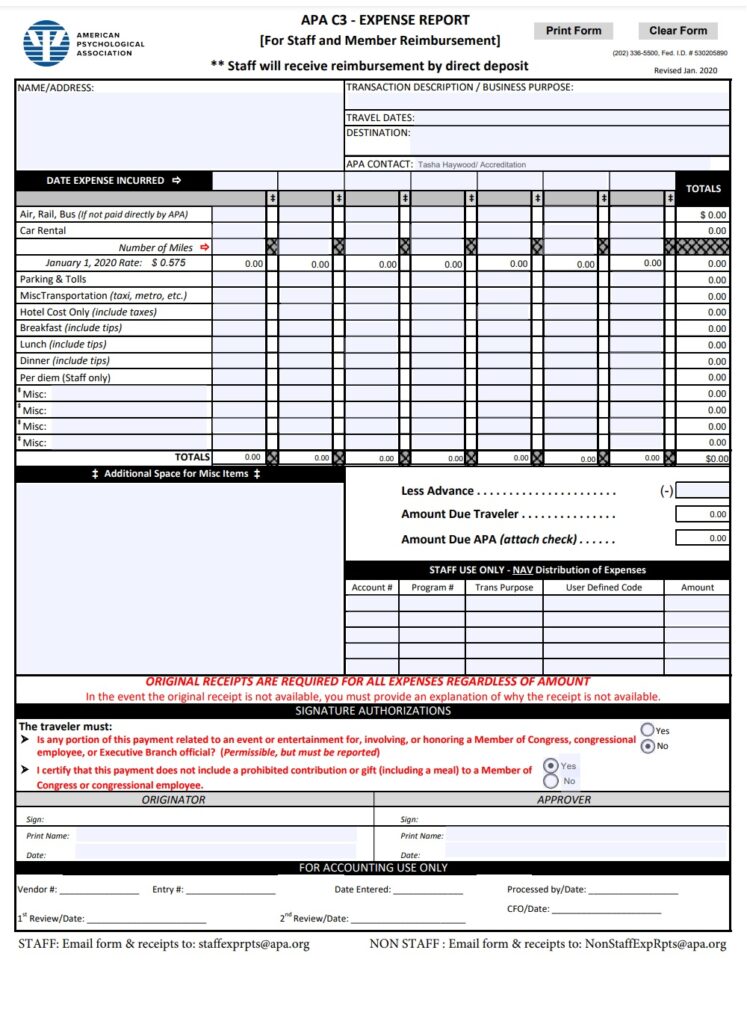

Source:www.apa.org

Source:www.apa.org

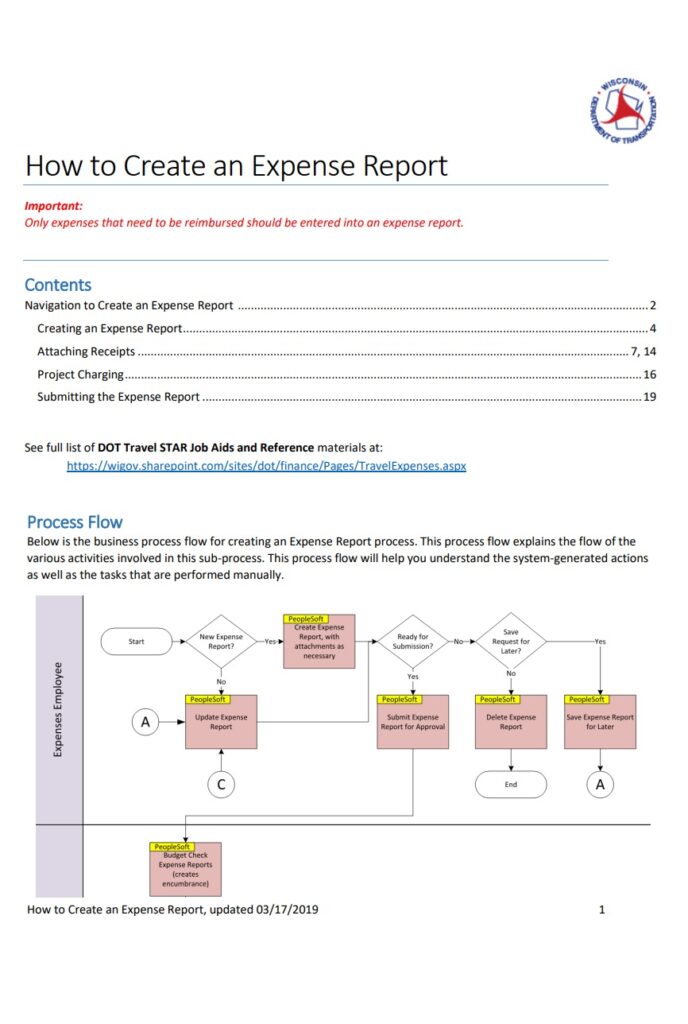

Source:wisconsindot.gov

Source:wisconsindot.gov

Source:internal.simmons.edu

Source:internal.simmons.edu

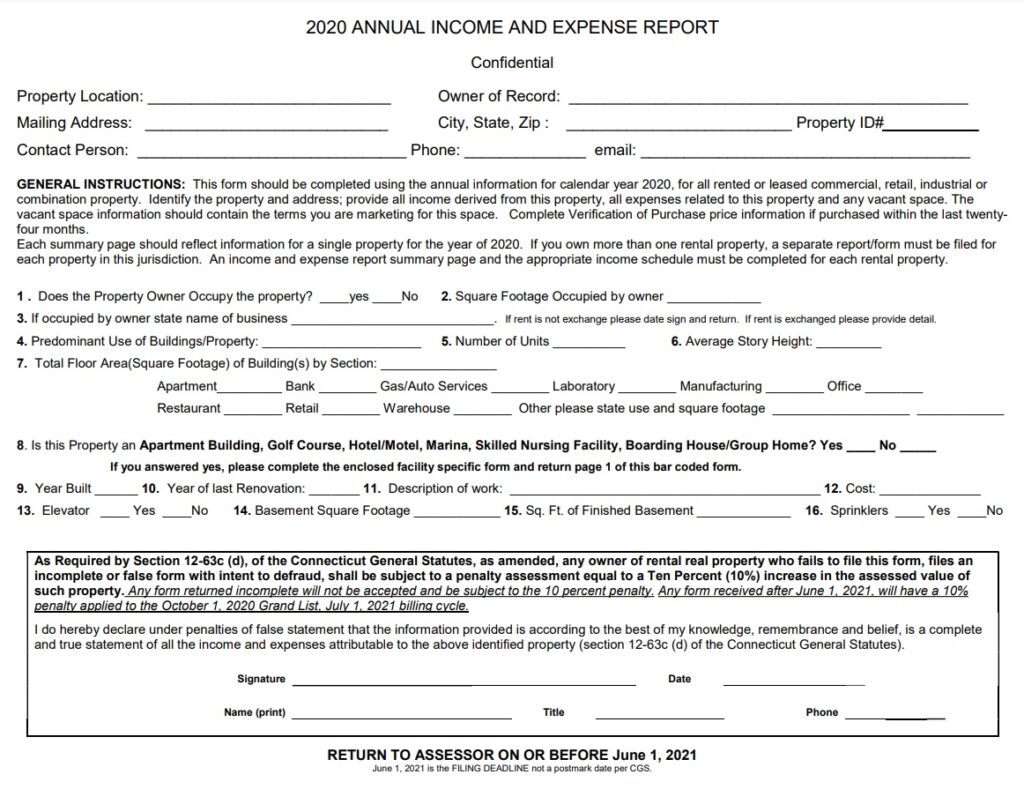

Source:www.meridenct.gov

Source:www.meridenct.gov

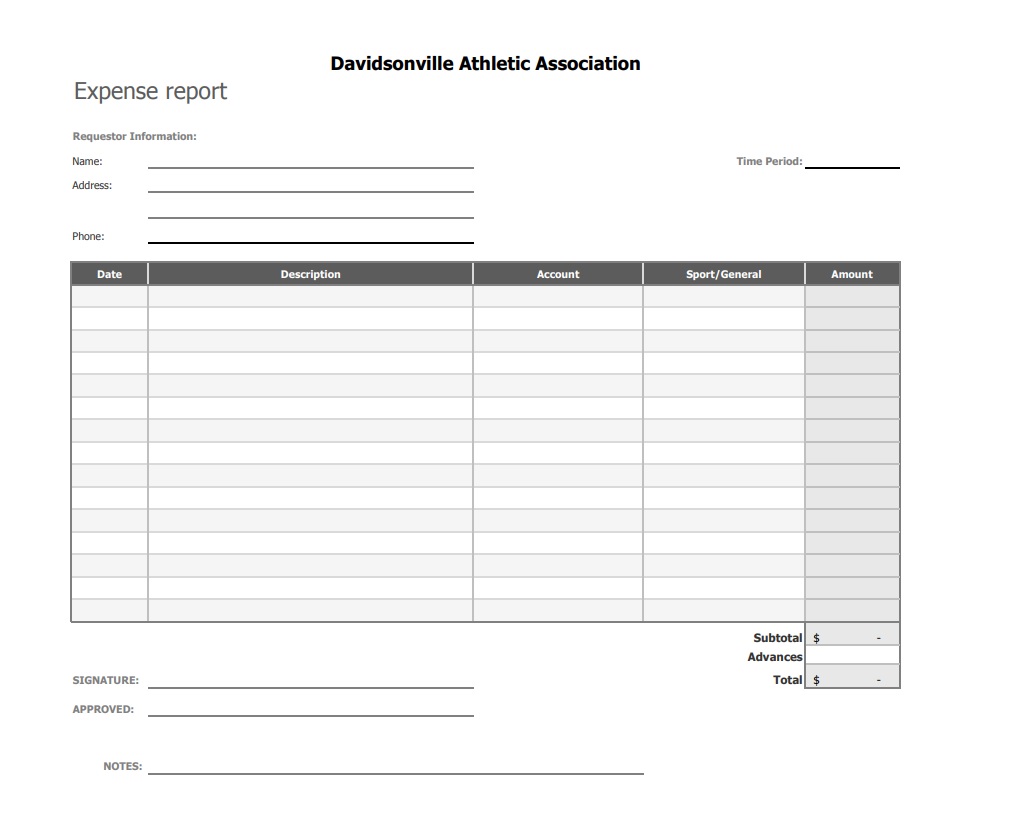

Source:files.leagueathletics.com

Source:files.leagueathletics.com

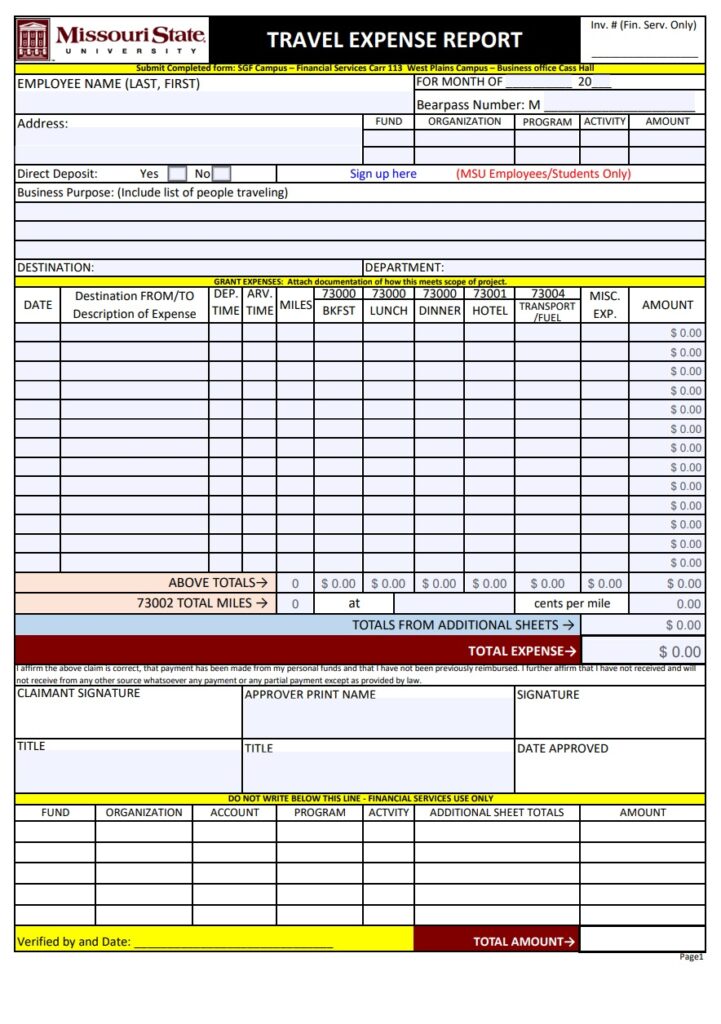

Source:apps.missouristate.edu

Source:apps.missouristate.edu