A consolidation report example is a reporting tool that is used to summarizes financial information from multiple entities into a single, comprehensive view. It combines the financial statements of subsidiaries or business units to present a unified picture of the entire organization’s financial health. This report is crucial for stakeholders, investors, and management to assess overall performance and make informed decisions based on consolidated financial data.

The Purpose of a Consolidation Report:

In simple terms, a consolidation report is a document that shows the combined financial results of a group of companies as if they were a single entity. When a company owns or controls other companies, it often prepares individual financial statements for each subsidiary. However, for a complete picture of the group’s overall financial health, a consolidation report adds up the financial information from all subsidiaries to present a unified view. This helps stakeholders, such as investors or management, understand the overall performance and position of the entire group rather than looking at each company separately.

The Functionality of a Consolidation Report:

The following are the functionality of a consolidation report, which are as follows;

Aggregation of Financial Information:

The consolidation report aggregates the financial information of multiple entities within a group. It combines the assets, liabilities, equity, income, and expenses of these entities to present a consolidated view.

Elimination of Inter-company Transactions:

Inter-company transactions and balances need to be eliminated to avoid double counting and to reflect the true economic substance of the group. The consolidation report adjusts for these transactions to ensure accuracy.

Consolidated Financial Statements:

The primary output of the consolidation process is the preparation of consolidated financial statements. These statements include a consolidated balance sheet, income statement, and statement of cash flows, providing a holistic view of the group’s financial performance.

Equity Accounting:

The consolidation report applies equity accounting principles to reflect the ownership interests in subsidiaries. This involves recognizing the parent company’s share of the subsidiaries’ equity and adjusting for any non-controlling interests.

Compliance with Accounting Standards:

The consolidation report ensures compliance with relevant accounting standards and regulations, such as International Financial Reporting Standards or Generally Accepted Accounting Principles.

Financial Analysis and Decision-Making:

Stakeholders, including investors, analysts, and management, use the consolidation report for financial analysis and decision-making. It provides a comprehensive picture of the group’s financial health and performance.

The Usage of a Consolidation Report:

As far as the usage of a consolidation report is concerned, the following common usages are given below;

Personal Finance Management:

If you have multiple bank accounts, investments, or financial assets, you might create a consolidation report to get a comprehensive view of your overall financial situation. This report could include information on your income, expenses, savings, and investments, helping you make informed decisions about budgeting and financial planning.

Debt Management:

Individuals with multiple debts, such as credit cards, loans, or mortgages, may use a consolidation report to gather information on their outstanding balances, interest rates, and monthly payments. This report could aid in developing a strategy for debt repayment or considering debt consolidation options.

Investment Portfolio:

If you have investments in various stocks, bonds, or other financial instruments, a consolidation report can provide an overview of your portfolio’s performance. This can be valuable for making investment decisions, rebalancing your portfolio, or assessing the need for diversification.

Real Estate Holdings:

Individuals with multiple properties or real estate investments may use a consolidation report to track property values, rental incomes, and expenses. This can help in assessing the overall performance of the real estate portfolio and making strategic decisions about buying, selling, or managing properties.

Business Ownership:

If you own multiple businesses or have investments in different ventures, a consolidation report can be useful for understanding the overall financial health of your business interests. It can include information on revenue, expenses, profits, and other key performance indicators.

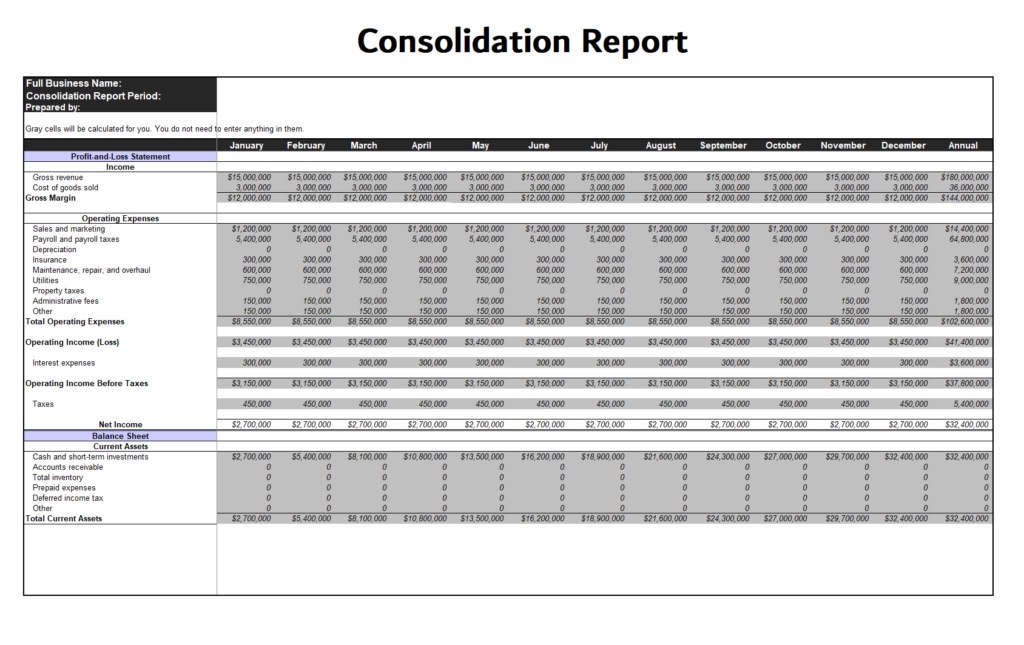

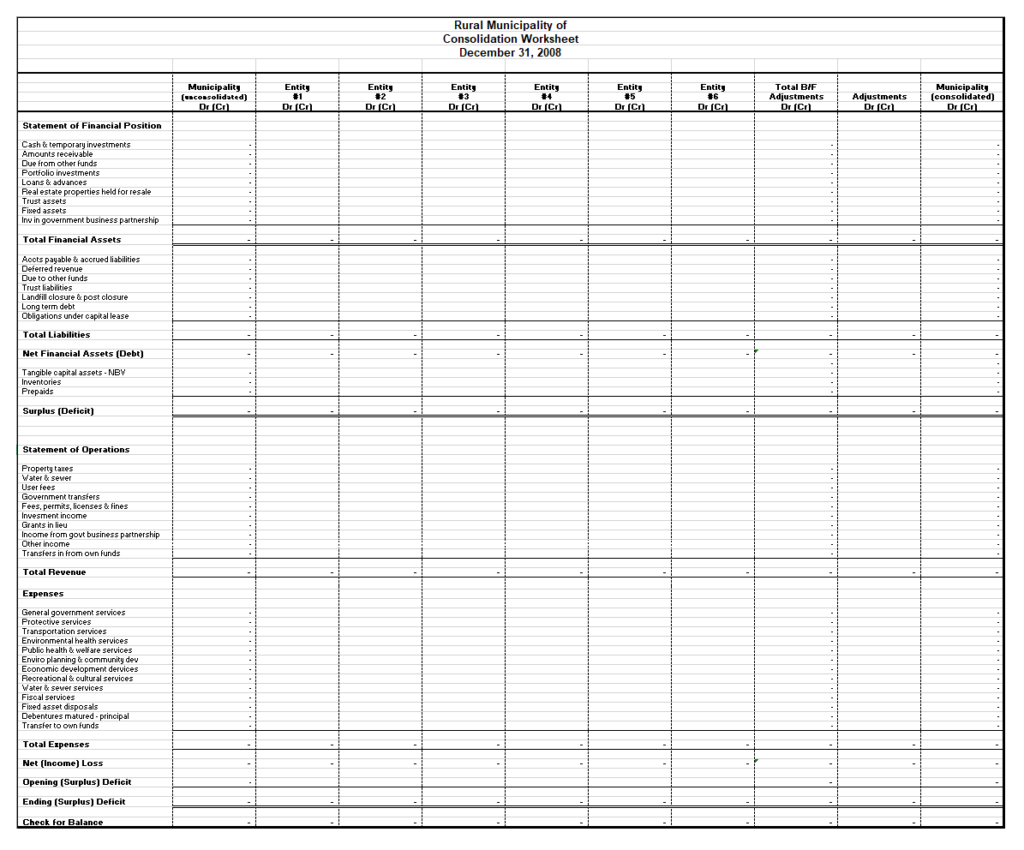

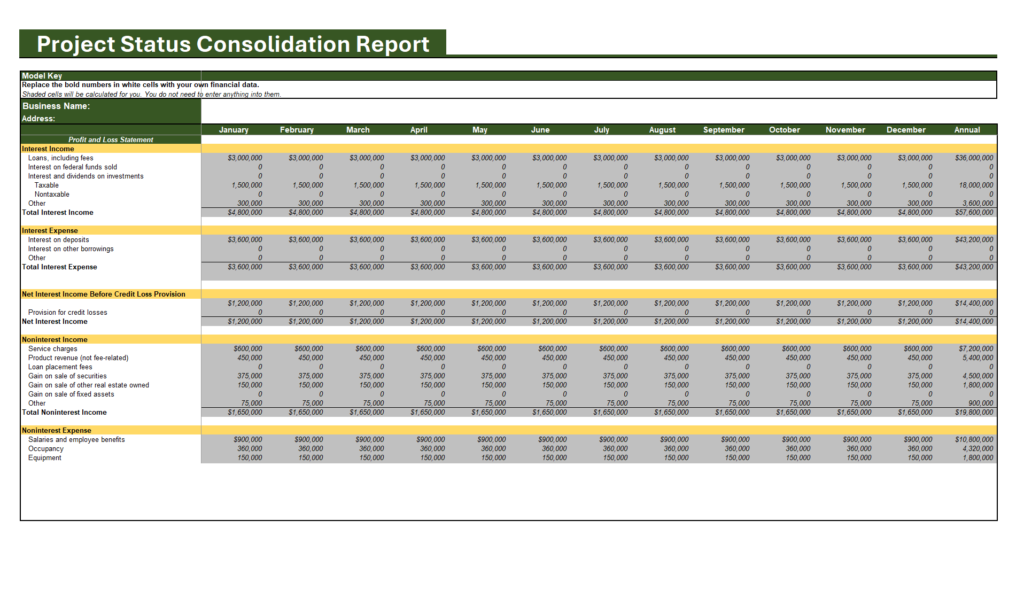

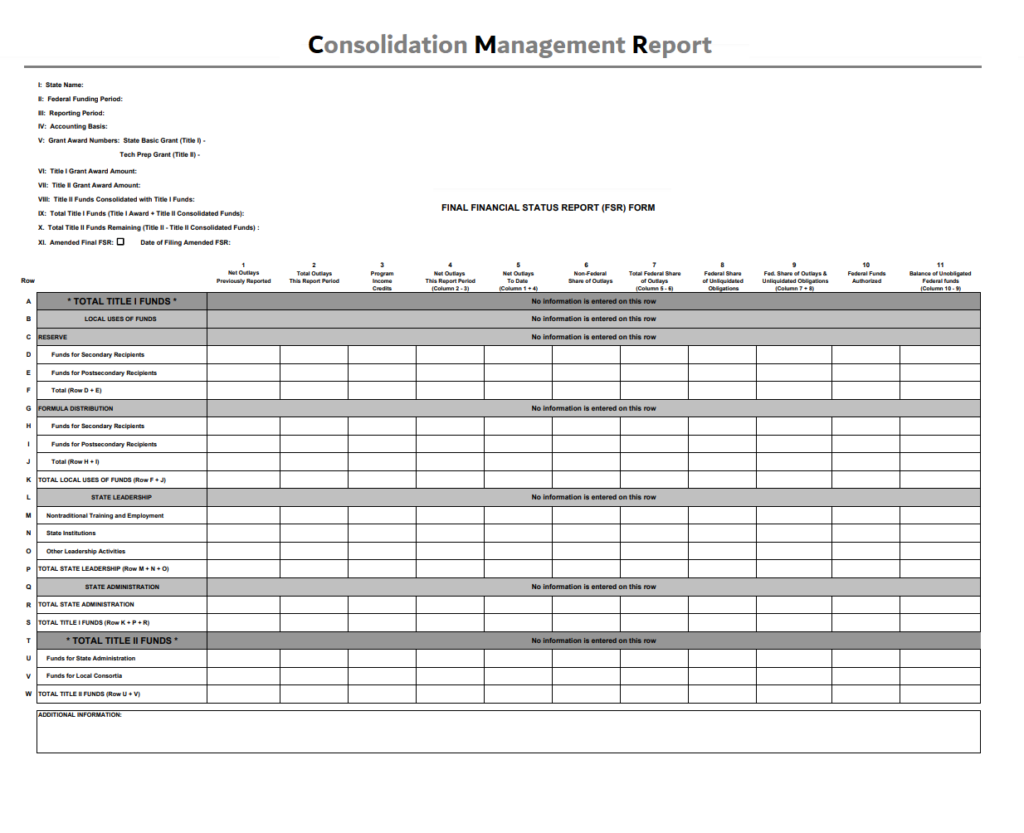

Templates for Consolidation Report:

gov.mb.ca

gov.mb.ca

www2.ed.gov

www2.ed.gov